Introduction to Mining Cabins in Nevada

Nestled among the rugged landscapes of Nevada, mining cabins not patented but pay taxes in nevada qui tell a story as rich as the minerals they were built to support. These structures stand proudly in remote areas, serving not only as shelters for miners but also as historical markers of an industry that has shaped the Silver State. Despite their significance, many mining cabins are not patented—yet they still contribute to local tax revenue. This intriguing paradox raises questions about property rights and economic impact in a region steeped in mining lore. Let’s delve into why these unique cabins operate outside the realm of patents while dutifully paying taxes, and explore what it means for both miners and the communities surrounding them.

The History of Mining Cabins and Patents in the State

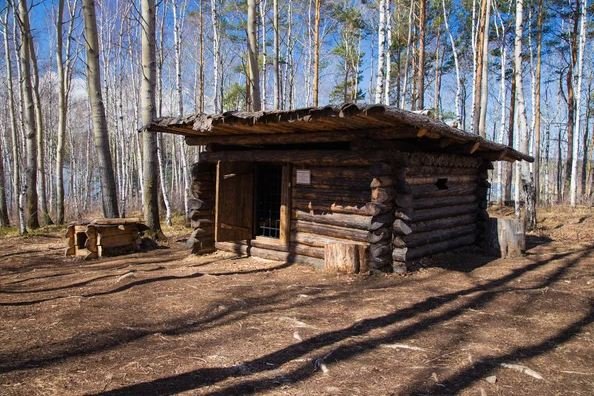

Mining cabins in Nevada have a rich and storied history. They emerged during the gold rush era, serving as essential shelters for miners braving the harsh conditions of the desert landscape. These simple structures were often built using local materials, emphasizing practicality over aesthetics.

As mining boomed, so did interest in land patents. Miners sought to secure their claims through legal means. However, many opted against patenting their cabins due to various reasons such as costs and bureaucratic hurdles.

Without formal patents, these cabins became informal symbols of resilience and hard work. Despite lacking official recognition, they contributed significantly to Nevada’s cultural heritage. Over time, this unique dynamic between unpatented mining cabins and state regulations has shaped local policies surrounding land use and taxation.

Reasons for Not Patenting Mining Cabins

Many miners choose not to patent their cabins due to the financial burden associated with the process. Patenting requires significant fees and ongoing maintenance costs, which can strain already tight budgets.

Another reason is the complexity of legal requirements. The patenting process involves extensive paperwork and often lengthy approval times. Many miners prefer to focus on their operations rather than navigate bureaucratic hurdles.

Additionally, some see patents as unnecessary in regions where land use rights are well-established through other means. For them, maintaining a cabin without a formal patent provides enough security for day-to-day needs.

The transient nature of mining work also plays a role. Miners may move between sites frequently, making it impractical to secure permanent ownership of cabins that might not be used year-round. This fluid lifestyle often leads them to opt-out of securing patents altogether.

The Taxation Process for Mining Cabins in Nevada

Mining cabins in Nevada are subjected to a unique taxation process that reflects their unconventional status. While many properties require formal patents, these cabins often do not follow the traditional route.

Instead, they are taxed based on their assessed value and usage. This means owners must navigate local regulations to ensure compliance while assessing appropriate tax obligations.

The state utilizes an annual property tax system for these structures. It’s crucial for cabin owners to stay informed about changing regulations and rates each year.

Additionally, county assessors play a key role in determining how much tax is owed. They may evaluate factors like location, size, and condition of the cabin.

This approach can create challenges for miners who rely on these cabins for work or shelter but still face financial responsibilities tied to taxes despite lacking patent protections. Understanding this landscape is essential for managing costs effectively.

Impact on Miners and Local Communities

Mining cabins play a crucial role for miners in Nevada. They provide shelter and a sense of stability amid the rugged terrain. Without these cabins, many would struggle to find safe resting places during long work hours.

The presence of mining cabins also influences local communities. They foster a unique bond among miners, facilitating social interactions and support networks. Such connections can enhance overall morale and productivity within mining areas.

Moreover, the taxation on these cabins contributes to community resources. Local governments can fund schools, roads, and essential services thanks to this revenue stream.

However, challenges arise when it comes to maintenance and infrastructure around these non-patented properties. Limited legal recognition may lead to uncertainty about ownership responsibilities among cabin owners.

This dynamic continues to evolve as both miners and communities navigate their respective needs amidst changing regulations and economic pressures.

Potential Solutions or Alternatives

One potential solution for mining cabins not patented but paying taxes in Nevada is the creation of a specific licensing framework. This would allow miners to continue using their cabins without the burdensome process of patenting.

Another alternative could involve offering subsidies or tax incentives for those who choose to maintain their cabins legally. Providing financial assistance might encourage compliance while ensuring that local communities benefit from these operations.

Additionally, forming cooperative associations among cabin owners can foster collaboration and resource sharing. By working together, they can tackle regulatory challenges more effectively and create a united voice in discussions with local authorities.

Exploring innovative land use agreements could pave the way for new models of ownership and responsibility. Such arrangements might grant rights without full patents, giving miners security while contributing positively to state revenue through taxes.

Conclusion

Mining cabins play a unique role in the landscape of Nevada. They serve as more than just structures; they are symbols of the rich mining history and culture that has shaped the state. The absence of patents for these cabins raises questions about property rights and ownership, especially when taxes continue to be collected.

The reasons behind not patenting mining cabins are multifaceted. Regulatory frameworks often prioritize land use over individual cabin ownership, creating a complex web of legalities that can leave miners feeling uncertain about their investments. Despite this lack of patent protection, the taxation process remains consistent. Miners pay their dues, contributing to local economies while navigating an intricate system designed around mineral rights rather than building ownership.

This situation impacts both miners and surrounding communities significantly. While locals benefit from tax revenues generated by these operations, there is an ongoing conversation about fairness and equity within the framework governing mining activities in Nevada.

Alternative solutions could enhance clarity around ownership without impeding traditional practices tied to mining cabins. Discussions regarding simpler licensing or permit systems may provide benefits for all stakeholders involved.

Understanding why mining cabins are not patented but still subject to taxes highlights deeper issues within property rights in Nevada’s unique context. As discussions evolve around mining policies, it becomes essential to consider how adjustments could support both miners’ interests and community needs simultaneously.